In 2025, two in five companies are turning to outsourcing to attract new skills and save costs. This way, they free up resources to focus on their core business goals. At the same time, outsourcing is becoming a large part of the economy’s income for some countries.

In this article, we’ll review outsourcing statistics driving the market in 2025. Keep reading to find out the key industry and regional trends.

Before you get to the complete list, here are the most notable outsourcing trends:

Let’s start our overview with some brief facts about the outsourcing industry.

The global outsourcing market generated $854.6 billion in 2025

The industry will grow at a compound annual growth rate of 5.46% during the forecast period. The outsourcing market will reach a total market size of $1.11 trillion in 2030.

Source: Research and Markets

Global outsourcing stood at $29.6 billion in annual contract value (ACV) in three quarters of 2025

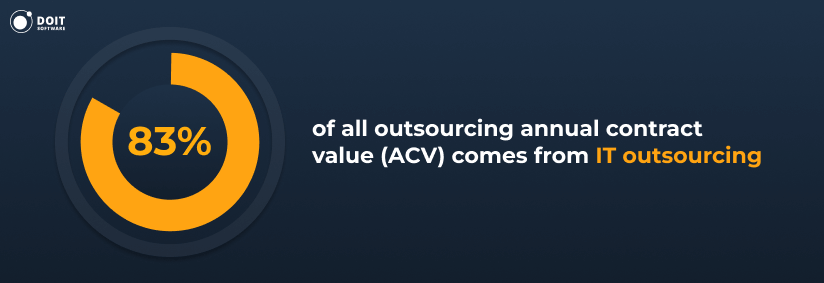

During the first three quarters of 2025, Information Technology Outsourcing (ITO) reached $24.6 billion in annual contract value (+5% year-to-date), making up 83% of all global outsourcing contracts. Business process outsourcing, in turn, generated $5 billion in ACV (-22% year-to-date).

Historically, in 2023, IT services outsourcing reached $30.4 billion (13% increase year-on-year). However, business services outsourcing was already declining by 14%, generating $10.3 billion in ACV.

Source: ISG Index

70% of organizations have brought some previously outsourced work back in-house over the past five years

While outsourcing continues to grow, many companies are also selectively moving certain functions back internally, a practice called insourcing.

Of those who have insourced previously outsourced work:

Primary reasons for bringing work back in-house include gaining better control over service quality (68%), building strategic capabilities internally (64%), and eliminating vendor markup costs (56%).

42% of companies turn to outsourcing to gain better access to skilled talent

Additional key drivers behind outsourcing decisions include:

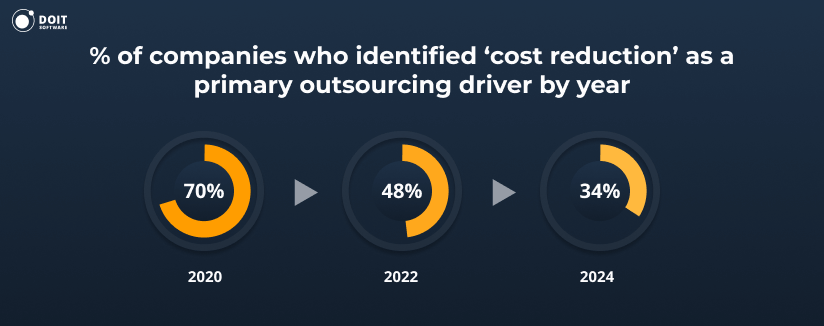

Cost reduction as the primary outsourcing driver has dropped from 70% in 2020 to 34% in 2024

In 2020, 70% of organizations that outsource identified cost reduction as the primary driver. In 2022, this number dropped to 48%, and in 2024, it fell to 34%.

Organizations using outcome-based outsourcing models are even less focused on cost as the primary driver. Only 30% of them cite it as their main reason for outsourcing. While cost efficiency remains important, organizations now prioritize access to skilled talent more.

55% identify lack of benefit tracking as the top challenge in outsourcing programs

According to Deloitte outsourcing statistics, the most common challenges organizations face with outsourcing are actually internal management issues, not vendor performance problems:

78% of organizations now operate their own offshore service centers alongside outsourcing relationships

Global In-house Centers (GICs), also called captive centers or capability centers, are company-owned service delivery centers located in different countries, often in regions offering cost advantages and skilled talent. These centers deliver services across functions like IT, finance, HR, customer service, and even research and development.

Of organizations with GICs:

GICs complement outsourcing by allowing organizations to keep critical knowledge in-house while maintaining lower cost structures than domestic operations.

56% of organizations plan to increase their outsourcing investments, while only 14% plan to reduce

Despite growing interest in bringing some work in-house or establishing offshore centers, traditional third-party outsourcing continues to grow. Investment outlook for outsourcing shows:

67% of organizations now use outcome-based outsourcing relationships instead of traditional staff augmentation

Two years ago, only 45% adopted outcome-based services (also called managed services or operated services). Traditional staff augmentation, where businesses rent workers by the hour, now represents only 29% of outsourcing arrangements.

83% expect their outsourcing vendors to bring AI capabilities as part of service delivery

2025’s outsourcing statistics suggest that companies expect third-party vendors to enhance their services and deliver value by embedding AI technologies and solutions into their operations.

The highest levels of expectation for AI-powered outsourcing are found in:

1. Utilities (89%)

2. Energy (87%)

3. Media and telecom (87%)

4. Real estate (85%)

5. Automotive (84%)

1. IT/Digital (87%)

2. Human Resources (87%)

3. Tax (84%)

4. Sales and Marketing (82%)

5. Finance (81%)

Despite high expectations for AI-powered outsourcing, the tangible benefits remain modest. Only 25% of organizations are seeing actual cost reductions in vendor services due to AI implementation. However, 1 in 2 organizations experienced efficiency and productivity gains.

Source: Deloitte outsourcing report

81% of companies want outsourcing providers to be strategic collaborators

Three out of four companies want help pursuing transformational outcomes, such as new business models and technological innovations like AI.

In the next two years (2026-2027), companies expect high impact from modern sourcing in four key areas:

The top goals for adopting modern sourcing include faster speed to market for new products and services, redeploying internal staff to other activities, predictable costs, improved stakeholder experience, and cost savings and efficiency.

Source: KPMG

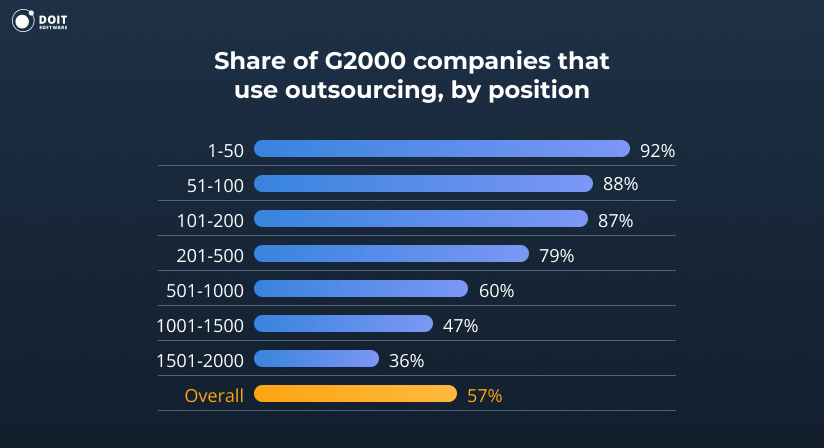

57% of all G2000 companies had at least one outsourcing contract

The highest level of outsourcing adoption (92%) occurred in the top 50 companies in the Forbes ranking. The lowest (36%) was in the 1501-2000 positions. So, service providers still have the opportunity to enter this market.

Of the G2000 outsourcing customers, 92% delegated IT support services, and 59% business processes.

Source: ISG

The outsourcing market comprises two sub-sectors: IT outsourcing (ITO) and business process outsourcing (BPO).

ITO includes cybersecurity, software development, AI, data and analytics services, etc. BPO covers legal, HR, financial, customer, and marketing support. Let’s have a further look.

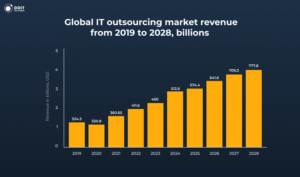

The global IT outsourcing market hit $588.38 billion in 2025

Despite a slight decline in 2020, the industry will grow steadily at a CAGR of 6.51% from 2025 to 2030, reaching $806.55 billion by 2030.

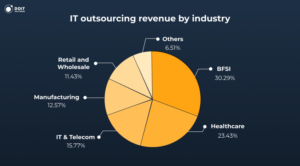

BFSI (banking, financial services, and insurance), healthcare, and IT & telecom generate the most significant revenues for IT outsourcing.

Thus, the BFSI industry outsources the most and spent 30.29% of the sector’s total value, i.e., about $155 billion in 2024. Healthcare IT services spending, in turn, amounted to $120 billion.

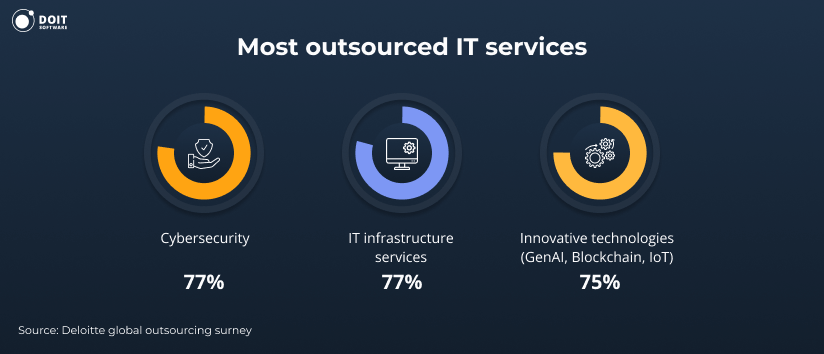

77% of businesses that outsource do it for their IT functions

Historically, they spent an average of 8.1% of their budget on IT outsourcing services in 2023. It is 1.7% more than in 2019.

Companies most often use external service providers in the following IT areas:

The cybersecurity outsourcing market hit $1.6 billion in 2025

In its previous reports, Gartner predicted that by 2025, a lack of talent will be the cause of over half of significant cyber incidents.

That’s why 93% of organizations planned to outsource parts of their workflows to security vendors over 2024-2025.

Security services accounted for 42% of companies’ total risk management costs today. They spent on consulting, IT outsourcing, implementation, and hardware support. In total, these costs reached $90 billion in 2024, up 11% from 2023.

Source: Gartner, PRNewswire, Data Insights

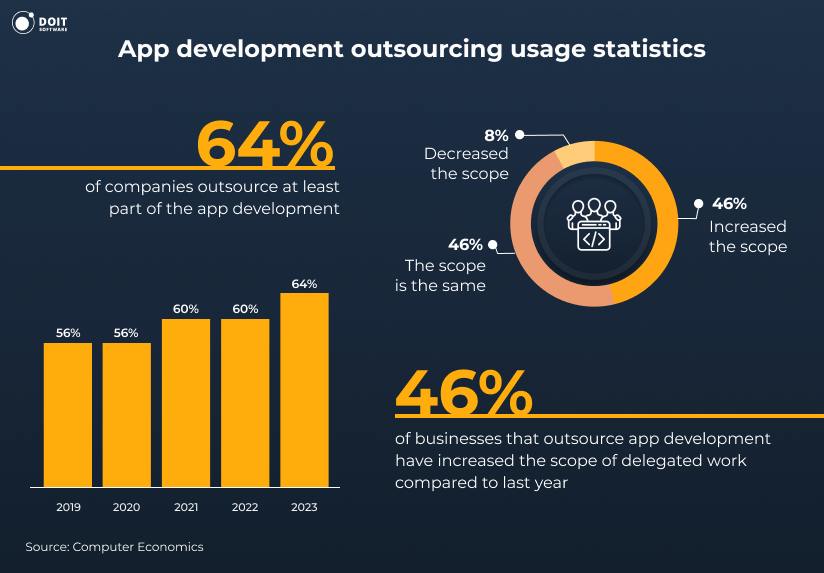

64% of organizations outsourced at least part of their app development in 2023, up 8% from 2019

Of them, 46% said they had increased the work delegated to outsourcing companies, and only 8% had decreased it.

59% of small and medium-sized businesses outsourced app development

Small businesses delegated about 45% of their IT work to outsourcing vendors. In turn, 68% of large companies do so, but with only 39% of their tasks in the ratio.

The most frequent clients of outsourced app development companies are the following industries:

About 69% of businesses have the same or lower costs for outsourcing app development than when handling it in-house

On the other hand, only 54% of outsourcing customers say that the quality of the development services they receive is better or on par with their internal efforts.

Source: Computer Economics

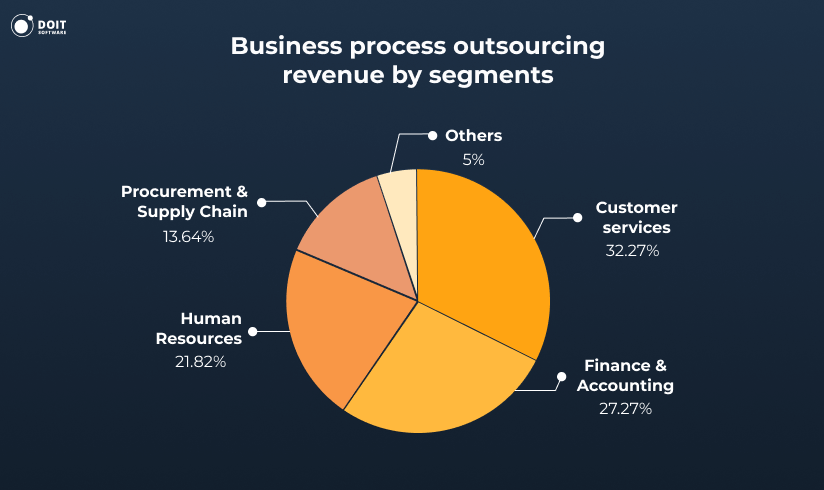

The business process outsourcing industry reached $415.73 billion by the end of 2025

Forecasts say that the market will grow by 9.4% per year until 2030, hitting $491.15 billion.

2018

0.27

-

2019

0.28

↑ 3.7%

2020

0.27

↓ 3.6%

2021

0.3

↑ 11.1%

2022

0.33

↑ 10%

2023

0.35

↑ 6%

2024

0.37

↑ 5.7%

2025

0.42

↑ 5.39%

2026*

0.44

↑ 4.8%

2027*

0.46

↑ 4.5%

2028*

0.47

↑ 2.2%

2029*

0.48

↑ 2.1%

2030*

0.49

↑ 2.1%

* Projected values

Within this industry, customer service outsourcing generates 32.27% of revenue. Other large segments are finance and accounting (27.27%) and HR (21.82%).

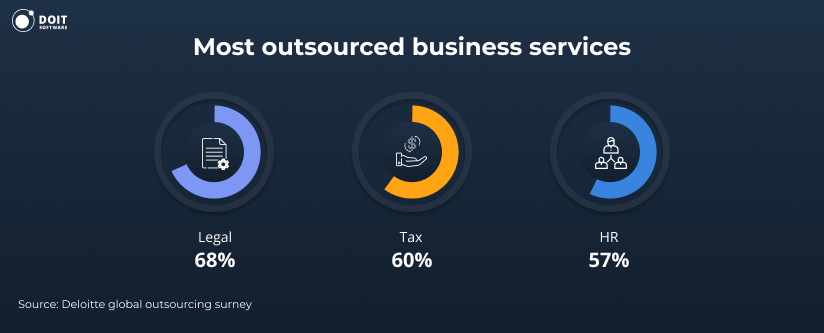

68% of executives who outsource do so for business functions

The most outsourced services are:

56% of organizations now outsource front-office functions like sales, marketing, and customer service

Organizations are moving beyond traditional back-office outsourcing to delegate customer-facing and revenue-generating activities. It represents approximately a 10% increase compared to the 2022 findings.

Additionally, 46% now outsource research and development activities, another core business capability traditionally kept in-house. This expansion into front-office and R&D outsourcing is common globally and across industries, with real estate, energy, and consumer products showing the highest levels of adoption.

Source: Statista, Grand View Research, Deloitte

The global legal process outsourcing (LPO) market reached $22.5 billion in 2024

It will grow at a CAGR of 31.4% between 2023 and 2030. The industry’s projected revenue will total $117.89 billion in 2030.

Asia Pacific led the LPO market in 2023 with over 71% global revenue share

Among them, India and the Philippines are the most popular destinations for legal services.

The e-discovery segment accounts for 22% of LPO income

Other popular services include litigation and patent support, contract drafting, management, and compliance help.

Source: Grand View Research

The F&A BPO market stood at $70.2 billion in 2025

By 2030, the global financial and accounting business process outsourcing (F&A BPO) will grow at a CAGR of 9.3% to reach $110.74 billion.

69.2% of the F&A BPO market belongs to large enterprises. Among them are Accenture, Infosys Limited, Capgemini, and IBM Corporation.

3 in 5 of F&A outsourcing contracts may not be renewed in 2025

Despite the growth, forecasts indicate that 60% of finance and accounting outsourcing contracts won’t be renewed by the end of 2025. The reason is outdated pricing models that don’t drive digitization and process improvement.

Source: Grand View Research, Gartner

Asia Pacific countries are the leaders in outsourcing attractiveness based on the Global Services Location Index. India, China, and Malaysia are at the top.

The GSLI ranks countries by digital resonance, business climate, skills availability, and financial attractiveness. Here are the top 5 rankings for each factor:

The United States ranks 8th with the lowest financial attractiveness. But it’s 1st for the highest human skills availability and 2nd for the best business environment and digital resonance after Singapore.

Let’s check out the outsourcing statistics by country in detail.

The United States holds the largest share of global IT outsourcing by revenue

The local market is forecast to reach $218 billion in 2025, up from $185.5 billion in 2024. It will grow at a CAGR of 6.24% to hit $295 billion by 2030.

The US accounts for 38.4% of the global BPO market revenue in 2025

The same goes for business process outsourcing – the US is in the lead, with a projected income of $159.75 billion in 2025, up from $134 billion in 2024. However, the growth here is forecast to be low – only 3.39% per year. As of November 2025, the US business outsourcing sector employs 658k people, +84k from 574k in 2024.

66% of US companies outsource at least one business process

It is over 300k American jobs. One of the main reasons for outsourcing outside the United States is to save money on wages and health insurance. For instance, the benefits account for 29.6% of employers’ potentially saved costs.

For example, when it comes to choosing a white label SEO outsourcing provider, 74% of business owners consider an SEO provider’s reputation “very” or “extremely” important. Specifically, 83% of respondents stated that SEO providers should be able to help them “access new customers”.

Source: IBISWorld, Bureau of Labor Statistics

APAC regions make up 23% of the total global IT outsourcing revenue. Forecasts show it will exceed $129.78 billion by the end of 2025 and grow by 7% from 2025 to 2030. The most prominent market players here are India, China, and the Philippines. Let’s take a closer look.

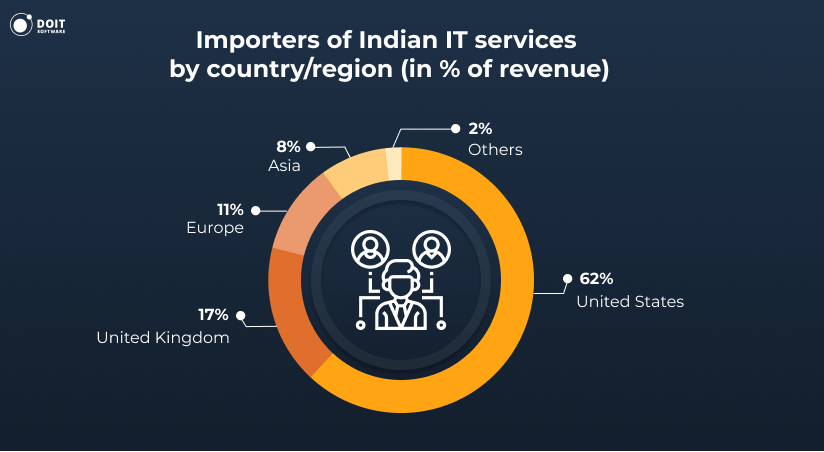

Being one of the largest outsourcing destinations, the Indian IT outsourcing market is forecast to reach $12.41 billion by the end of 2025, up from $10.51 billion in 2024. With a CAGR of 11.41%, it will almost double to $21.31 billion by 2030.

The US supplies 62% of the revenue for Indian outsourcing. The UK also contributes 17%, Europe 11% and Asia 8%.

Source: Statista

The IT outsourcing market in China reached $31.31 billion in 2025 (+8.39% from 2024). Business process outsourcing (BPO) was worth about $24.30 billion (up by 4.96% from the previous year).

If looking at historical data, in 2023, the fastest growth was in the following sectors:

At the end of March 2023, the sector had created 15.15 million jobs, with 64.7% of the workforce comprised of university graduates. In the first quarter alone, the industry added 177,000 new employees.

Source: Statista

IT services account for 17% and business services for 84%. The market expects to employ 1.5 million people in the coming years.

70% of revenue comes from North America, 15% from Europe and 15% from APAC. The most popular services are banking & finance (about 25%), media & telecom (14-18%), and retail (14-18%).

Source: IBPAP

Between 2018 and 2022, the European IT outsourcing market grew from €13.8 billion to about €21.8 billion in contracts per year (12% CAGR)

77% of EU companies that outsource IT do so within the European Union. They also actively delegate to other European countries (17%), India (17%), the UK (14%), or the US and Canada (11%).

The UK generates the largest revenue in the European region

By the end of 2025, the UK outsourcing market will amount to $44.5 billion. Here is a detailed list of the top countries by revenue in IT outsourcing:

UK

$44.5bn

7.18%

$62.96bn

Germany

$32.15bn

5.7%

$42.41bn

France

$27.52bn

5.65%

$36.21bn

Spain

$11.73bn

6.25%

$15.88bn

Netherlands

$11.58bn

5.81%

$15.35bn

Italy

$10.53bn

5.17%

$13.55bn

Switzerland

$7.59bn

6.36%

$10.32bn

Sweden

$6.36bn

6.38%

$8.66bn

Denmark

$5.34bn

6.39%

$7.28bn

Poland

$4.11bn

7.75%

$5.97bn

Finland

$4.11bn

5.8%

$5.45bn

Belgium

$4.08bn

5.51%

$5.33bn

Austria

$3.27bn

5.76%

$4.33bn

Norway

$3.06bn

5.68%

$4.03bn

Czechia

$2.42bn

6.39%

$3.3bn

Ireland

$1.78bn

6.24%

$2.4bn

Ukraine

$1.23bn

8.96%

$1.89bn

Notably, Ukraine and Poland will see the largest growth in the IT outsourcing industry over the next 5 years. Eastern Europe will become a significant hub for hiring IT specialists, which will determine the future of outsourcing.

During 2018-2022, the EU outsourcing market created 17,481 jobs. In contrast, the region lost 92,027 jobs (0.23% of all) due to outsourcing abroad.

Source: Eurostat

Outsourcing generated over $35 billion for LATAM economies in 2025

LATAM’s IT outsourcing market will reach $18.45 billion by the end of 2025, up from $15.92 billion in 2024. Forecasts suggest that it will grow at an annual rate of 7.12% and hit $26 billion by 2030.

Business process outsourcing is also stable at $16.59 billion in 2025, up from $14.76 billion in 2024. However, the growth rate here is lower (3.63%): by 2030, the market will hit $19.82 billion.

Brazil and Mexico lead the LATAM outsourcing market, with 70% of the region’s revenue

Here are the top LATAM countries leading by revenue in IT outsourcing:

Brazil

$6.76bn

7.14%

$9.55bn

Mexico

$6.05bn

6.88%

$8.44bn

Colombia

$803.10m

7.37%

$1.15bn

Chile

$765.52m

6.59%

$1.05bn

Peru

$622.06m

7.26%

$883.3m

Cuba

$511.21m

4.1%

$625.03m

Argentina

$486.38m

7.41%

$695.23m

Source: Statista

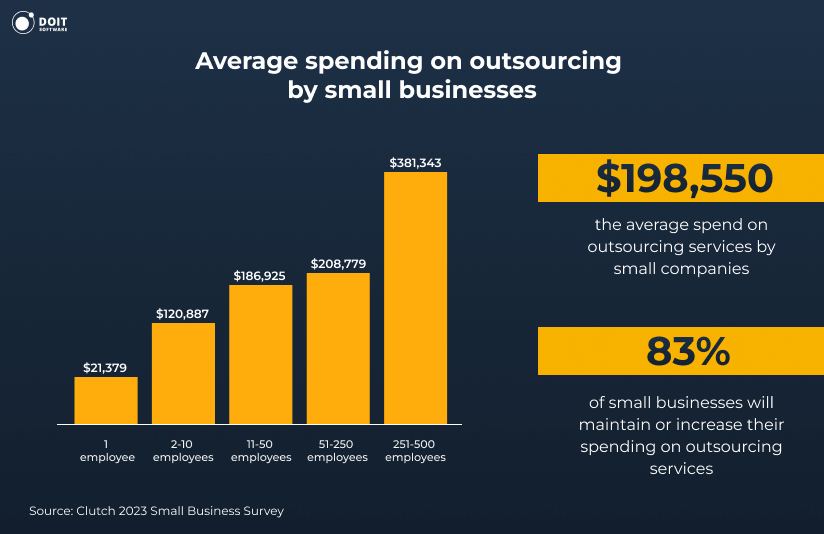

US small businesses spent an average of $198,550 on outsourcing services in 2022

And 83% of small businesses will maintain or increase their spending.

52% of small businesses use professional outsourcing agencies regularly

Most often, they look for external providers with expertise in:

Small businesses turn to outsourcing to reduce expenses, fill skill gaps, and scale up their business.

Source: Clutch

That wraps up our outsourcing statistics report for 2025. As you can see, the industry is still growing and attractive to companies of all sizes and industries. Today, 92% of enterprises outsource IT operations and 59% – business processes. And these numbers will be stable in the next 5 years. Challenges like declining skilled labor, rising customer expectations, and the need to reduce costs will continue to drive the sector.

In fact, the outsourcing industry has become a contributor to many global economies. Thus, firms get the services faster and cheaper, and developing countries boost their growth.

If you decide to start outsourcing or look for remote experts for your project, don’t hesitate to contact us. Here at DOIT Software, we know how to hire IT professionals across the US, LATAM, and Eastern Europe, so we can provide recommendations tailored to your needs.

The short answer is yes. The outsourcing industry is fast growing by an average of 5.46% annually. Today, 92% of G2000 outsource IT functions, and 59% – business processes. New challenges in cybersecurity, talent skills, growing customer needs, and cost-cutting drive even more firms to delegate at least part of their workflows.

About 77% of companies outsource at least part of their IT. Most often, it’s cybersecurity and software development services.

The IT outsourcing market will reach an estimated $854.6 billion by the end of 2025. It accounts for 83% of the annual contract value of global outsourcing.

Companies often outsource manufacturing to Asian countries. For example, Dell to Lebanon, India, Poland, Malaysia, and China.

Citi and Oracle delegate IT operations to Eastern Europe, India, and the Philippines. American Express and AT&T also outsource customer service to the Philippines.