The financial sector has always been at the forefront of digitization and pushing the technology further to deliver security, stability, and user satisfaction. Fintech app development provides more freedom to banking and other financial institutions, offers higher security and convenience to the customers, as well as makes banking accessible to people from different countries and backgrounds. If you are thinking about creating a banking or financial app, this article will teach you about the various types of fintech solutions, the essential requirements for the fintech market, as well as the cost of financial app development. Keep reading to discover more!

Fintech stands for financial technology and refers to web and mobile applications that optimize, automate and improve financial services for businesses and customers. Using modern technology and security best practices for fintech application development, companies can deliver easy-to-use and safe software solutions for streamlining financial operations, such as managing wealth for high earning individuals. In recent years, the market has expanded and shifted towards customer-oriented products such as neobanks, education portals, stock market apps, investment solutions, and more.

Digital transformations in banking have helped financial institutions solve many common problems that users and companies face. Among them are:

What software solutions are at the top of the market? Explore the five best fintech apps, their features, and their unique value propositions in order to realize your own project. This will also ensure that it will meet the market standards and compete with the best solutions.

New York City, New York, USA

Features

– No minimum account balance requirements;

– Budget planning and tracking;

– Price Match gets you reimbursed for purchased items if you discover them at a lower price.

Unique feature

Instacash allows users to borrow a portion of their stable income and repay it within two weeks without extra fees.

New York City, New York, USA

London, England, UK

Features

– Works with 130+ currencies and provides cheaper international transfers;

– Offers exchanges and payments with cryptocurrencies;

– Spending tracking and budget planning.

Unique feature

Disposable virtual cards that can be quickly generated to make a payment and automatically removed or changed to avoid fraud.

London, England, UK

São Paulo, Brazil

Berlin, Germany

Berlin, Germany

Singapore

At the top of the best insurance apps, you will find Allstate Mobile App (iOS and Android) that provides a full set of services to access insurance policies, claim reports, optimize payments, and even receive roadside support. For investment apps, you can explore Invstr (iOS and Android), an app that offers courses on investment, provides fantasy stock games to train your skills, and helps you establish and maintain your investment portfolio. Brigit (iOS and Android) is an industry-leading cash advance app that allows you to borrow up to $250 without undergoing a credit check or paying any interest on the loan.

DOIT Software team delivers high-functioning applications with a large emphasis on user experience. Share your app idea with us to check out our fintech application development services.

Fintech app development services can help you with various types of applications for different target audiences and purposes. In this section, we will go over the main types of fintech mobile applications, pointing out their benefits and costs of development.

Insurance apps help users find an appropriate insurance plan as well as calculate the possibility of incidents that might require their use. The types of insurance include various purposes such as life, travel, healthcare, car, and others. These applications connect insurers and the insured by allowing customers to get instant help as well as choose the most suitable and affordable plan. Insurance companies on the other hand enjoy the exposure and can establish a closer bond with their user base. They can streamline claims management, provide easy access to policies and ID cards, automate payments, and offer 24/7 customer support. For building insurance apps, get in touch with the mobile app development services providers who are prominent in developing a solution as per the requirements.

One of the most prominent examples of insurance apps is Oscar. This app makes health insurance more accessible by eliminating copays and coinsurance costs. Users can also schedule appointments with physicians and receive test results and prescriptions via the app.

The average cost of insurance fintech app development is about $70,000 to $90,000.

Investment solutions unlock the exclusive world of investment and make it more affordable and attainable to the average person. These apps are mainly focused on inexperienced people that do not have thousands of dollars at their disposal. Users can receive tips from specialists, start investing with just a few dollars and even play fantasy stock games to figure out how the market operates. Users can also learn more about cryptocurrencies, discover their trends, and invest in the ones that are likely to grow in the future.

Acorns is the most popular investment app for newbies that offers small steps of investment by rounding up every purchase and collecting the difference to make an investment. The application is perfect for users who are new to the market and cannot afford to invest substantial amounts of money.

The cost of developing an average investment application is about $120,000 to $140,000.

Banking apps bridge the gap between financial institutions and unbanked citizens. There are still many people in the world that cannot afford to open a traditional bank account due to the minimum requirements. Banking applications solve this problem and allow everyone access to convenient, secure, and affordable banking services.

Ally is one of the newest banking apps that offers advanced fintech app security and an easy-to-use interface. Besides accessing and transferring their money, users can also utilize investment features and customize a debit or credit card. Finally, the app incorporates services to transfer money simply using the person’s phone number or email address instead of extensive banking information, leveraging the capabilities of a finance data warehouse.

The cost of mobile application development for banking depends on the complexity of the app and starts at $100,000.

RegTech stands for regulatory technology and includes compliance, identity management, risk management, regulatory reporting, and transaction monitoring. The industry caters to companies that use cloud computing and SaaS to ensure compliance with regulations. Their main goal is to utilize the latest technologies such as Machine Learning and Big Data to minimize potential breaches and hacks, and to increase compliance. By incorporating regtech solutions in the banking sector, these technologies can further streamline compliance processes and enhance monitoring accuracy.

Alyne is a compliance management cloud solution that helps companies evaluate their risks and make informed decisions. Their digital dashboard allows businesses to monitor their compliance requirements and perform risk analysis. As a result, companies are more cognizant of their cybersecurity and compliance performance, and can enhance the missing parts thereof.

The cost of regtech financial apps development starts at $150,000.

Peer-to-peer lending apps strive to help people acquire loans for their business ventures, pay off their student debts, and even make a down payment on their new house. Instead of using financial institutions and paying off high interest rates, people can access more attractive options through these loan apps. Another viable option is cash advance solutions that allow users to borrow smaller amounts of money, usually about $250 per day and pay it back without any interest.

Kiva is a peer-to-peer lending app that allows people to lend $25 and more to any individual or cause they prefer. Once the borrower pays the loan back, users receive the lent money that they can reloan or withdraw.

Loan lending app development can be quite basic and still contain all the critical functionality necessary, while costing somewhere between $60,000 and $80,000.

Applications that help individuals manage their personal finances are another type of the fintech market. They facilitate budgeting, accounting, invoice processing and management, as well as provide insights into personal finance. Users can learn about investment options, tax advice, and insurance types that suit their jobs and plans. Personal finance apps range from providing educational material and offering accounting software to giving out personalized tips based on the user’s information.

Mint is a personal finance application that encompasses budgeting, financial goal setting, expense tracking, reporting, and more. The app also helps users keep their accounts safe by alerting them about unusual activities.

The costs of personal finance mobile app development vary from $80,000 to $100,000.

The process of fintech app development is lengthy and complicated and requires great technical experience, as well as a deep understanding of the market and target audience. In this section, we will explore the eight essential steps toward creating a fully functioning fintech application. How to build a fintech app that works smoothly, attracts users, and generates income? Keep reading and you will find a step-by-step guide to developing a competitive software solution.

The first step of fintech mobile app development is to research and learn as much as possible about the market, potential users, and competitors. The fintech industry is vast but it’s essential to understand the intricacies of the market, trends, main players, risks, opportunities, etc. After grasping the idea of how the market operates, reach out to your primary target audience to learn about their pain points. Based on that, you can start developing a unique value proposition that will help you stand out from the competition. Another helpful technique for investigating the market and your UVP is to conduct SWOT and PEST analyses.

Having market data and the pain points of the target audience at hand, you can figure out which app type would be suitable to tackle the problem. Within the fintech industry, there are different types of applications that can be developed. For example, an insurance app can help connect insurance companies with clients or facilitate an internal management system for insurance firms. The appropriate model may also depend on your budget as some apps are quite costly even when they are kept basic.

Your fintech app development team depends on the tech stack that you choose. If you aren’t sure which technology would be the perfect fit for your project, consult with a fintech application development company. Browse through various fintech development companies, check out their portfolios and case studies, and get in touch with them to learn more about their experience and rates. Make sure the company can take on your project and has the team composition for a fintech app development project: fintech app developers, business analysts, project managers, UI/UX designers, and QA specialists.

UI/UX design is the focal point of any application as it determines how the user will perceive the solution. Cumbersome and complex fintech app design and navigation can ruin even the greatest app idea. In the user-oriented fintech app development strategy, it is vital to create a design that will appeal to the target audience and make the product usable and helpful. UX design is also about ensuring that the user solves their problem as quickly as possible. This may require shortening the sign-up process by offering face recognition or document scan features, or skipping some other redundant steps.

Besides complying with industry-standard privacy laws like GDPR and CCPA, fintech app development requires companies to adopt protection systems such as Know Your Customer (KYC) and Anti Money Laundering (AML). However, the full extent of compliance depends on the target country. Some countries, (like the US), do not require any special compliance besides the aforementioned ones, and state and federal laws. How to make a fintech app that adheres to the laws and regulations of your target country? Research the information relevant to your location to make sure your application is compliant with the local laws.

There are four monetization models that most applications use: freemium, commission, subscription and in-app ads. All of the above can be applied to fintech applications. Consider your fintech app idea, target audience, and market to determine which monetization model is the most suitable for you. You can also combine various models and try out different options to establish which one works the best for your product.

MVP stands for minimum viable product and serves as a crucial step to validation of your app idea. An MVP is a simplified version of your future app that includes only the essential features that are sufficient to solve the user’s problem. Another benefit of an MVP is attracting investors with a complete functioning product as opposed to a vague idea. Adding this step to your finance app development process will definitely increase the chances of a successful project. Look into fintech app development companies that can provide MVP development services and stay within your budget.

An MVP will help you collect initial feedback from your audience and get an idea of what needs to be improved in further fintech app development iterations. Conduct A/B testing, consolidate the comments and brainstorm with your team to make the appropriate adjustments. Your team may need to repeat this process a few times before they get it down perfectly and create an app that users would want to use. However, the world of tech requires continuous improvement, ongoing support and maintenance, and feature expansion.

DOIT Software is a fintech app development company that is ready to undertake any challenge and deliver a high-performance application.

Reach out to share your ideas and receive a quote.

Fintech app development requires businesses to take into account a set of important requirements. Dealing with people’s finances is a responsible endeavor and needs to be taken seriously. Losing or mistreating someone’s finances can lead to devastating consequences, including jail time. How to create a fintech app that meets the market requirements? Make sure you consider the following points in your fintech application development process.

The costs of fintech app development are contingent on complexity, tech stack, location and the number of features. Let’s take a look at a cost breakdown based on the fintech app features of a simple investment solution.

Sign-up

70

2,800

Profile edit

70

2,800

Bank account (link and set up)

200

8,000

Dashboard on the home screen

150

6,000

Payment gateway

120

4,800

Stock management (search, filter, select)

310

12,400

Sell stocks

50

2,000

Shopping cart

60

2,400

Admin Panel Development

Sign-up

20

800

User management

100

4,000

Transaction management

100

4,000

Withdrawal management

70

2,800

Customer query management

25

1,000

Total

1,345

53,800

With the technology market growing every day, you can take advantage of some of the latest developments to enrich your application. Adopting emerging trends will enhance your fintech app development and deliver a competitive edge that any new product requires. In this section, we take a look at the most prominent trends that the fintech market is experiencing.

Financial institutions deal with vast amounts of data to be able to accurately predict and recognize trends and patterns. Traditional data management systems cannot handle such a large amount of data, which creates even more urgency in expanding Big Data initiatives. Collecting information will help you get valuable insights that for instance, within insurance apps, can be used for risk analysis. Another use case for Big Data in fintech is accurate fraud detection that is based on capturing and analyzing usage patterns.

Machine Learning is a technology that cannot be avoided when building a fintech app. You can implement algorithmic trading, detect fraudulent behavior and more. In the financial industry, machine learning algorithms can help companies make forecasts pertaining to market risks, reduce fraudulent activities and even unlock future opportunities. Finally, this technology allows for robo-advisors that help users make smart investments and educates them about the trends and strategies.

According to the Deloitte research, 76% of banking executives claim that in 5 to 10 years digital assets might completely replace the traditional currency. Besides enabling cryptocurrency, blockchain also increases efficiency by skipping the central intermediary that authorizes the transaction. As a result, the transfers will be completed a lot faster than with traditional banks. Blockchain developers can also improve the transparency and security of transactions by relying on a distributed database.

Additionally, this technological advancement has paved the way for innovative applications beyond financial transactions, such as those created by a blockchain game development company, which leverages blockchain to redefine gaming experiences with enhanced security and verifiable ownership of in-game assets.

Gamification within the fintech app development sphere refers to placing interactive dashboards, issuing personal badges, and engaging people to complete specific tasks. Investment apps also utilize this approach to incentivize users to begin investing even when they don’t have any funds, by offering fantasy trading. Gamification increases engagement and simplifies the learning curve for the user to make financing, accounting and investing accessible.

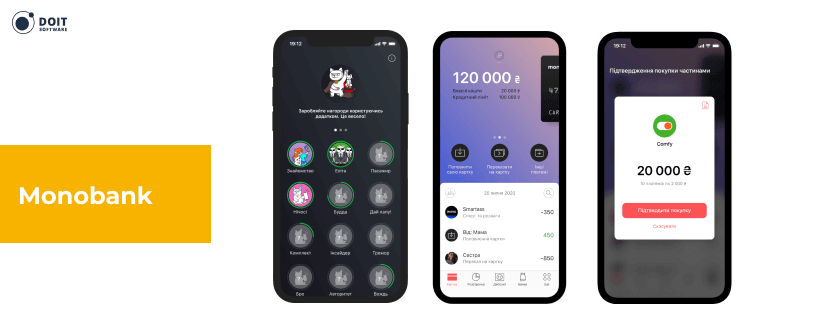

A primary example of banking app development with the gamification feature done right is the Monobank app. Users can earn achievement badges by performing tasks like spending on certain categories, sending money abroad, and splitting their bills with friends. The app has 1.3 million daily users and tracks well on app stores due to its excellent services and fun gamification elements.

By the way, one of the most prominent features of Mono is to pay your bill in a restaurant or find a friend’s card nearby by shaking your phone with an opened mobile banking app. And for this action, you can get a badge as well.

RPA is a technology that utilizes bots to automate mundane and repetitive tasks that do not require any brainpower. For example, data entry or information processing can be delegated to the bots to free up your employees’ time and reduce operating costs.

Voice-enabled technology allows users to use their devices by saying voice commands. This technology is especially important if you would like to make your app more inclusive. Voice recognition allows visually impaired users to make purchases, check their balances and make other operations without any issues.

Biometric authentication includes facial and voice recognition, fingerprint analysis and even more advanced techniques like palm vein patterns, iris recognition and retinal scanning. These authentication methods will significantly increase the security of users’ finances and can fully replace PINs and passwords that often fail.

Although smart contracts have blockchain behind them, they are more than that since they also use automated clearinghouses and central securities depositories for bond issuance. Smart contracts eliminate third parties and increase the efficiency of transfers by accelerating the speed and reducing costs. They also improve transparency and accountability and eliminate overhead management.

The fintech market will certainly continue to grow and make our finances safer. If you would like to enter this market, contact the fintech developers at DOIT Software to discuss your fintech startup ideas and get a quote. Get in touch with DOIT Software to start realizing your app.

Transform your idea into a successful product with the DOIT Software team.

Contact usA fintech mobile app is a mobile solution that helps businesses and individuals streamline their financial operations through the use of modern technology.

The cost of fintech web application development or mobile development services varies with the type of app and its complexity. For example, a loan lending app can cost as low as $60,000 whereas an investment app costs at least $120,000.

Fintech app development includes various types of apps such as apps for investments, banking, personal finance, insurance, peer-to-peer loans, cash advance, regtech and others.

Fintech app development can be monetized through commissions on transactions, in-app ads, subscriptions and freemium options.

Visit the company’s website to check out their case studies to determine whether or not they have the appropriate experience. Get in touch with various mobile banking application development companies to ask further questions about their workflow and to receive a quote. A responsive company that answers your inquiries and stays in touch is a sign of a reliable team.