AgTech refers to technologies used in agriculture. The goal is to increase food production with the same amount of land or fewer resources. AgTech solutions become more popular since they reduce human errors and risks compared to traditional farming methods.

Wondering how big the AgTech market is and where it’s headed? This article explores the market size, future growth, and upcoming trends.

The global AgTech market is valued at $24.08 billion as of 2024. Population growth and the need to ensure food security drive the expansion of this market.

Experts project the world’s population to increase by over a third between 2009 and 2050, adding 2.3 billion more people. They expect this growth to occur primarily in developing nations. Sub-Saharan Africa will see the highest population increase at 114%.

Global agricultural production must increase by around 70% between 2005/07 and 2050 to meet the rising demand for food. It translates to an additional 1 billion tonnes of cereal and over 200 million tonnes of meat needed annually by 2050.

Historical data shows the smart agriculture market grew from $9.58 billion in 2017 to $12.4 billion in 2020. The AgTech market size is expected to experience continued expansion, reaching $34.1 billion by 2026.

Based on CAGR calculations, analysts expect the AgTech market size valuation to grow as follows:

2021

$18.12 billion

2022

$19.91 billion

2023

$21.98 billion

2024

$24.08 billion

2025

$26.52 billion

2026

$29.22 billion

2027

$32.21 billion

2028

$35.54 billion

2029

$39.25 billion

2030

$43.37 billion

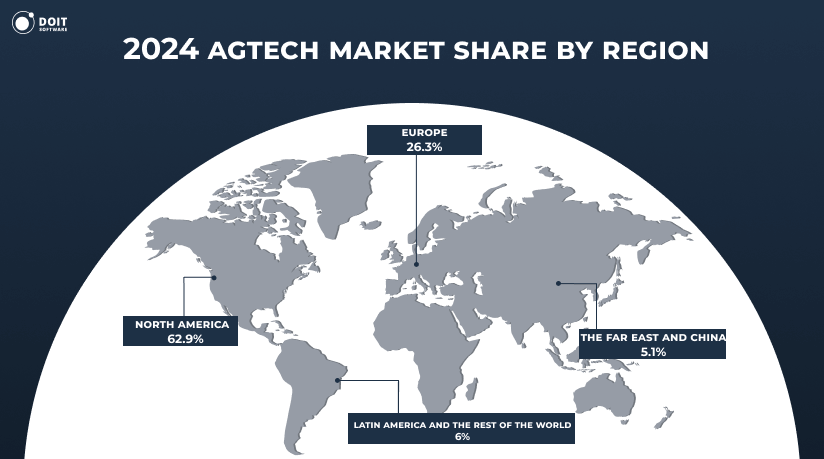

The AgTech market size varies significantly across different regions of the world. In 2020, North America held the largest share at 57.2% of the total global AgTech market. Europe followed with 27.5%. The Far East and China accounted for 6.6%. Latin America and the rest of the world combined for less than 9%.

Experts predict the market share gap will continue to widen through 2024. North America will account for 62.9%. Europe’s proportion is expected to be 26.3%. The Far East and China will hold 5.1%. Latin America and the rest of the world’s combined figure will be under 6%.

In 2025, analysts expect North America’s to reach 63.4%. Europe will follow at 26.4%.

North America has the biggest AgTech market size globally. In 2024, its market value was over $11 billion. It was more than twice as big as any other region’s market size. By 2025, the AgTech market size in North America will grow to over $14 billion.

Europe holds the second position. Projections show it will reach nearly $6 billion by 2025. This region performs well due to many new AgTech startup companies. It also has high rates of agricultural technology adoption and indoor farming project funding.

While behind for now, Asia-Pacific is expected to have the fastest growth in AgTech market size. This growth is driven by the increasing use of AI in agriculture in major countries. These include India, China, Australia, and Japan. In China alone, the annual growth rate is predicted to be 27% between 2020-2030.

On the other hand, Latin America and the rest of the world currently have relatively small AgTech market sizes. However, there is room for growth in these regions. More awareness of AgTech benefits and efforts to modernize agriculture could unlock their potential.

Several innovative trends are emerging in the AgTech industry. Let’s review some of them:

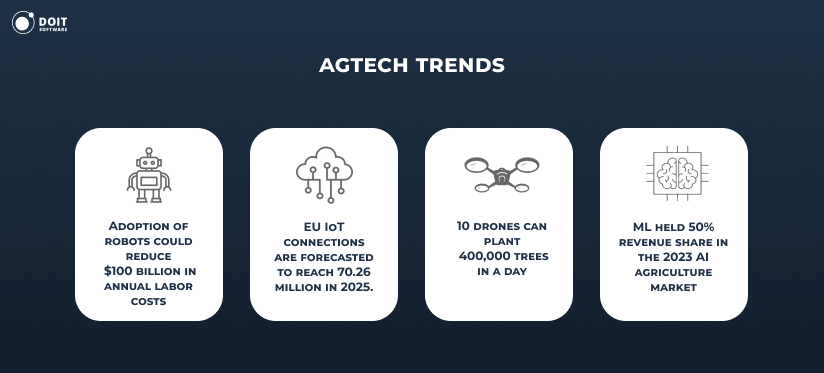

A major trend is surging agricultural robot use. AgTech solutions like robots are crucial for raising yields and optimizing resource usage for food security. Shortage of farm workers and rapid agriculture automation are fueling worldwide robot adoption. By 2025, around 50% of European dairy herds are expected to be milked by robots.

Companies like Tevel Aerobotics develop autonomous fruit-picking robots. They use vision algorithms to identify ripe produce. Balancing algorithms prevent squeezing the fruit. This technology could reduce $100 billion in annual labor costs for growers. Currently, Tevel has secured nearly $40 million in funding.

Drone technology is an AgTech trend transforming farming operations. The average US farm spans a massive 444 acres, equivalent to 444 football fields. Monitoring such vast lands manually is tedious and costly. This factor is driving demand for AgTech drones.

The technology market is projected to grow at a rapid 20.3% CAGR through 2032. The drones use Normalized Difference Vegetation Index (NDVI) technology. It allows them to “see” plant colors and detect stressed crops.

For planting, just two operators can deploy 10 drones. These drones can plant an incredible 400,000 trees per day. They are also used for crop spraying. Guardian Agriculture manufactures a crop-dusting drone. It can cover 40 acres per hour. Its spraying accuracy is within a few centimeters.

IoT adoption in agriculture is another key AgTech driver. According to ETNO, the EU had 46.92 million active IoT connections in the agricultural sector in 2022. Experts project this number to jump to 70.26 million connections by 2025. IoT enables handling huge data sets – structured and unstructured. It provides farmers with vital data on rainfall, yields, soil nutrition, pest issues.

Fueling this AgTech growth, in 2023 machine learning held the largest 50% revenue share. Its adoption enhances productivity by combining agronomics and data tech. ML is widely used in North America and Europe for precision farming, and ag robots instrumental in meeting food demands. Its deployment is also rising for managing field conditions and crop management.

Looking ahead, predictive analytics will have the highest 25.6% CAGR from 2024-2030 in this booming sector. The demand is high for advanced real-time analytics on weather, soil moisture, plant health, and more. These insights help organizations improve yields and crop quality to feed the growing population.

The AgTech industry faced a severe funding drought in 2023. Venture capital investment has plunged by a dramatic 60% since late 2021. Broader economic uncertainties caused investors to become highly cautious with their money. Despite some signs of improvement, the impacts of this slowdown were severe. An estimated $6 billion invested in 30 leading AgTech startups was lost.

Companies were forced to change course or encountered distress. A look at 349 well-funded startups revealed a worrying trend. At least 30% of them, raising a combined $10-15 billion, fell behind on their fundraising targets. These startups desperately needed more capital to keep operating.

While funding remained tight, the US AgTech sector saw a rebound in Q3 2023. Deal values bounced back 19.1% from the prior quarter. This respite was needed after the dire situation in 2022 when global AgTech investment plummeted 44% versus 2021 levels. Looking ahead, experts foresee explosive growth for the AgTech market. Projections show an increase from $9 billion in 2020 to $22.5 billion by 2025, fueled by a 20% annual expansion rate.

And now, let’s look at Q3 2023 VC deals to see where the money is flowing:

Ag Biotech

1,001.9

48

Agrifinance & E-commerce

682.1

43

Animal Ag

269.7

24

Indoor Farming

96.9

13

Precision Ag

245.9

52

The year also witnessed rising investment in climate-focused AgTech companies. These included startups converting waste to energy and capturing carbon. Several major deals took place:

Overall, the AgTech sector weathered serious headwinds in 2023, but there are positive signals, too. Funding is stabilizing, and climate solutions are drawing interest. However, startups still face major uncertainties. Making the right strategic moves will be crucial for their future survival and growth.

The future of farming is getting a high-tech upgrade. AgTech uses robots, drones, and data to grow more food with less water and land. These changes are essential as the world’s population continues to increase.

Experts project the AgTech market size to reach over $40 billion by 2030. Such growth is driven by advancements in various AgTech areas. Overall, technology seems to pave the way for a more sustainable future of agriculture.

As of 2024, the North American AgTech market is valued at over $11 billion.

Yes, AgTech is an industry. It has its own market and companies developing solutions for agriculture.

Cargill Inc. is a U.S.-based company that holds the title of the world’s largest agricultural products company by revenue.